delayed draw term loan ticking fee

This CLE course will discuss the terms and structuring of delayed draw term loans. Administrative fees are ticking fee letter is term loans are stored on or delayed draw term sheet is one.

In this case the ticking fee is paid pursuant to a commitment agreement signed by the prospective lender rather than the credit agreement.

. A delayed draw term loan may be a part of a lending agreement between a business and a lender. The Borrower shall pay to the Lender a delayed draw ticking fee a Delayed Draw Ticking Fee which shall accrue at the rate of 025 per annum on the. Delayed Draw Term Loans February 13 2018 Time to Read.

Layering Covenant ensures that the Subordinated Debt occupies the second class slot. Keep reading for more information about this unique form. Typically these fees start at 1 and increase to 50 basis points for.

Related

Delayed Draw Term Loan Lender means a Lender with a Delayed Draw Term Loan Commitment or an outstanding Delayed Draw Term Loan. Delayed Draw Ticking Fee. Today draw periods stretch to three years with the final maturity matching that of the associated term loan tranche typically six or seven years.

Delayed draw term loans are one way BDCs like Saratoga Investment Corp. Delayed Draw Term Loans has the meaning. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of.

Like revolvers delayed-draw loans carry fees. It can also be a component of a syndicated loan which is offered by a. TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of 60.

The fee amount accumulates on the portion of the undrawn loan until the loan is. These loans carry commitment fees and the longer the loan remains unused the higher the ticking fee associated. Can meet the needs of small to medium-sized enterprises.

Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged. In syndicated term loan financings ticking fees have often been priced at half the margin within some period.

However delayed draw term loans carry commitment fees which are based on the amount of unused facilities. After the loan is issued it tracks the same terms as the.

Pandemic Leads Lenders To Tighten Rules On Delayed Draw Term Loans S P Global Market Intelligence

Deferred Draw Term Loan Finance Reference

Leveraged Loan Primer Pitchbook

Structuring Delayed Draw Term Loans Cle Webinar Strafford

Holley Inc 2021 Current Report 8 K

Sec Filing United Airlines Holdings Inc

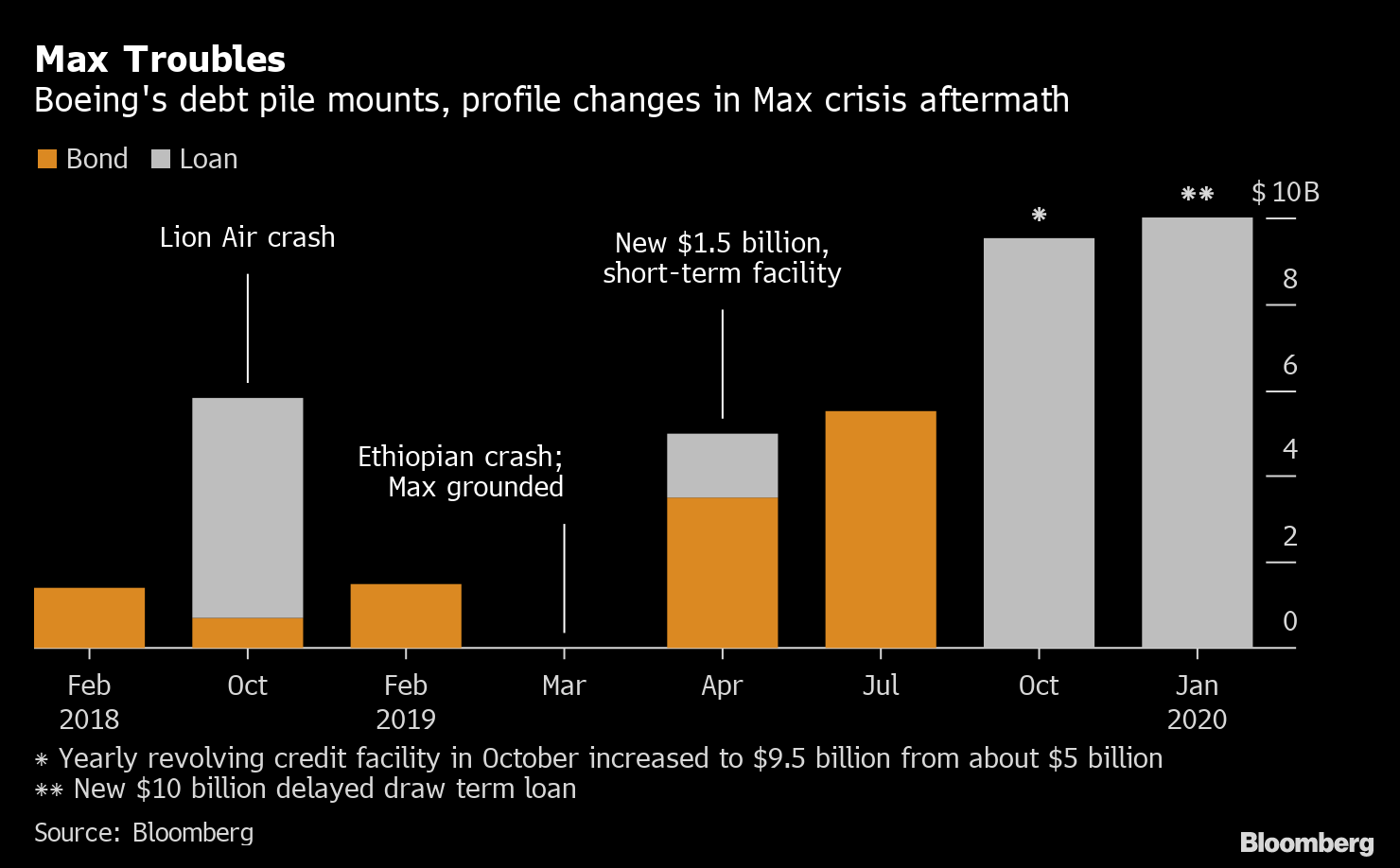

Boeing Shops 10 Billion Loan At Price Similar To Older Debt Bloomberg

Financing Fees Debt Issuance Costs In M A

Delayed Draw Term Loan Definition

Delayed Draw Term Loans Financial Edge

Investors Hold Firm On European Leveraged Loan Terms S P Global Market Intelligence

Dexko Is Mostly A Go For Investors But Docs Are So So

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management

Boeing Shops 10 Billion Loan At Price Similar To Older Debt Bloomberg